ASX 200 Outlook for the Week 14 – 18th Nov 2016

ASX200 Index: Commentaries for Week 14 – 18 Nov

What a roller coaster last week has been – all due to US election!

As they say in the market “expect the unexpected” – and this is what just happened. After a sudden and furious sell-off in the morning the 8th Nov (Australia time) and a low at 5052 level (this was expected in case of Trump win), the market came back and actually never looked back so it managed to close last week on a higher note at 5370.

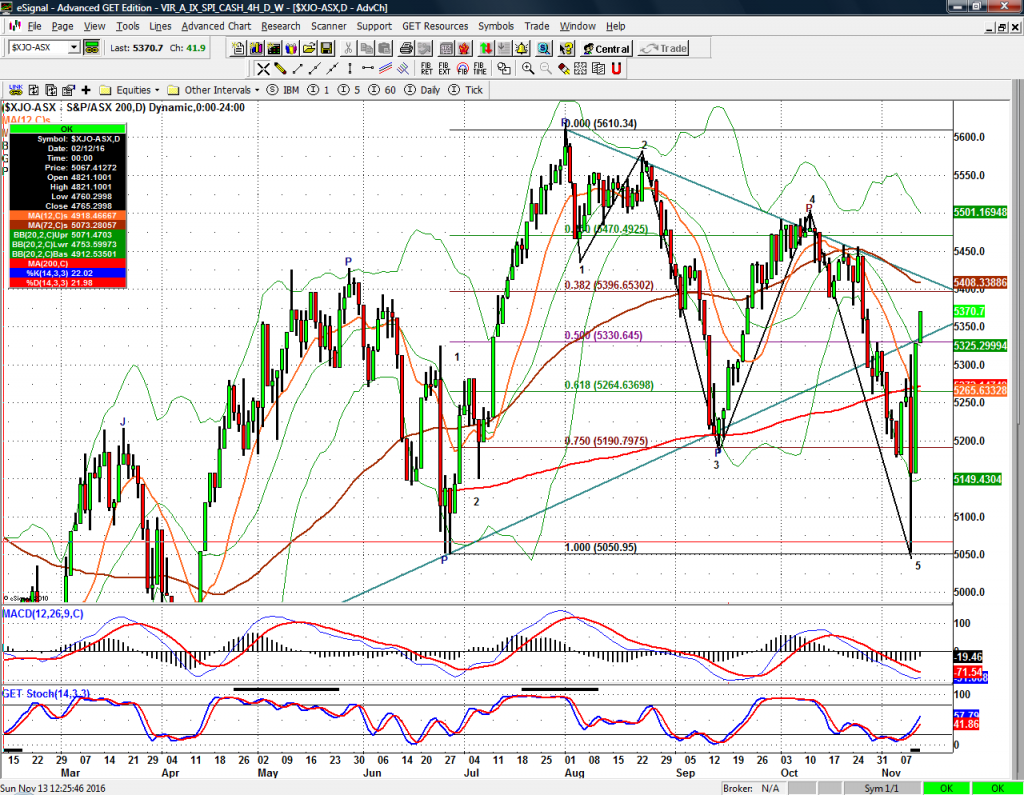

On the daily chart of ASX 200 index I have drawn the recent five waves down, starting from end of July and until now, Nov 11. Also take note of the downtrend line formed in the same period of time (the descending light green line).

According with the two reasons below we might have a bullish scenario:

- A completed down pattern – 5 waves down (even if we have wave 4 overlapping wave 1)

- Higher double bottom.

In spite of the above two reasons ,the market needs to ‘prove’ its bullishness and we should see the following happening for the ASX200 index:

- To take the 38.2% level at 5396 and go higher

- To break the downtrend line (descending light green line).

- Make a higher high above 5455 then 5498 levels

If all of the above are actually realized then we can say that the market is very bullish and trade confidently accordingly.