Technical Analysis Tools for Day Trader

Best Technical Analysis Tools for Day Trading

The best technical analysis indicators are those that result in making a trade more likely to be profitable for the long term. Having said that, I must also highlight that there is no indicator that will always result in a profit when trading any market.

So lets learn some of the most popular technical analysis indicators that are used by both traders and in automated trading:

MACD

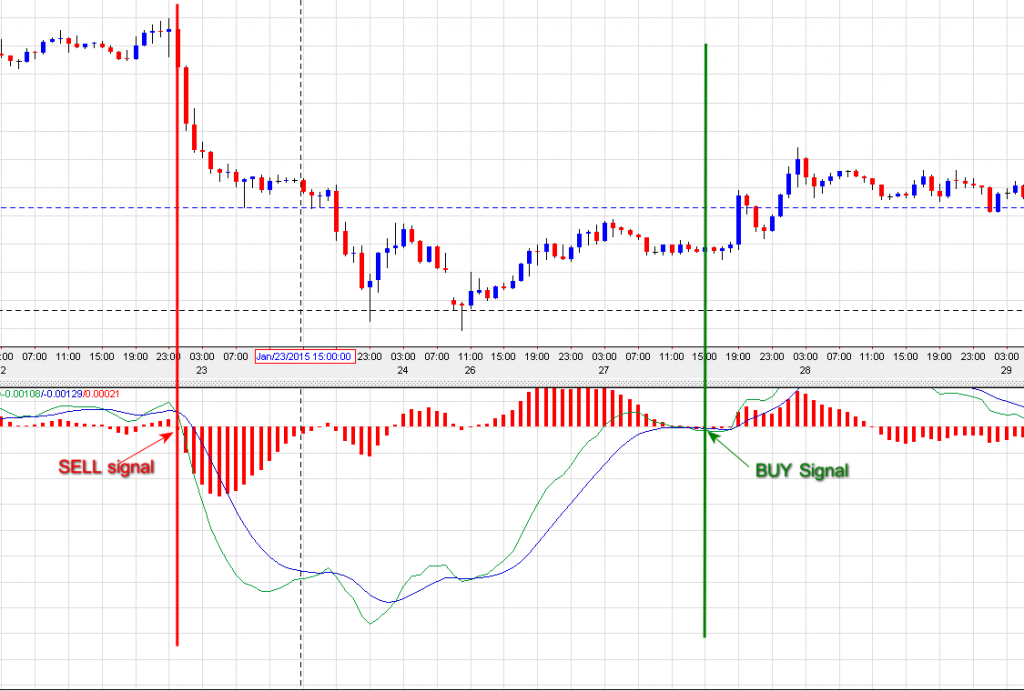

The Moving Average Convergence/Divergence (MACD) is probably the most used technical tool/indicator. It signals not only the trend, but also the momentum of the trend. The idea behind the MACD line is to compare the short-term and long-term momentum in order to estimate its future direction. Basically it is the comparison of two moving averages, which you can set for any time period you like, but typically the 12-day and 26-day moving average are used.

How to trade MACD signals

The idea behind MACD is that when the short-term line crosses the long term line, it is a signal of future stock activity. When the short-term line is running under the long-term line, and then crosses above it, the currency pair will typically trade higher. Likewise, we can predict a sell-off when the short-term line crosses under the long-term line. You can see both of these instances in action in the following chart:

Moving Average

Using moving averages to assess trend direction is the oldest form of technical analysis and remains one of the most commonly used indicators.

Moving averages provide input into the overall direction and momentum of a currency pair. Considered an “overlay” indicator, moving averages must be placed over the candlestick or bar price chart.

Because moving averages are easy to apply, they are often used in conjunction with other indicators to confirm a market direction.

The most commonly used by traders include the following:

- Simple Moving Average

- Weighted Moving Average

- Exponential Moving Average

How to trade single moving average signals

A sell signal is indicated when the price crosses under the moving average.

A buy signal is when the price crosses over the moving average.

How to trade signals produces by multiple moving average

Traders often place two or more moving averages on the same price chart- one of the moving averages is a faster moving average consisting of fewer data points, and one will be a slower mover average.

By definition, the faster moving average will be more volatile than the slower moving average.

The example chart below is using 10 Simple MA as a slow indicator and the 20 Exponential MA as a fast indicator:

Bollinger Bands

Bollinger Bands are placed over a price chart and consist of a moving average together with upper and lower bands that define pricing “channels”. Bollinger Bands identify the degree of real-time volatility for a currency pair and usually a sudden increase in volatility levels is a prelude to a trend reversal.

The greater the distance between the bands, the greater the overall exchange rate volatility.

The region between the average rate and the upper band is the buy channel – the region between the average rate and the lower band is the sell channel.

How to trade Bollinger Bands signals :

When the price falls outside the bands, it is said to be “breaking Bollinger bands”. Traders use the terms “overbought” to describe the situation where price breaks the buy band, and “oversold” when price breaks the sell band. Both are acknowledged as market reversal signals.

Stochastic

The stochastic oscillator is another well-known momentum indicator used in technical analysis. In an upward trend, the price should be closing near the highs of the trading range. In a downward trend, the price should be closing near the lows of the trading range. When this occurs, it signals continued momentum and strength in the direction of the prevailing trend. The stochastic oscillator is plotted within a range of zero-100, and signals overbought conditions above 80 and oversold conditions below 20.

How to trade Stochastic signals :

The Stochastic Oscillator produces three types of signals:

- Crossovers: used as both sell and buy indicators as the lines crossover in one direction or the other

- Divergence between the price and the indicators – indicates the possibility of a reversal of trend

- Overbought / Oversold signal when the indicator read above 80 or under 20

See some of the signals given by the Stochastic oscillator on the chart below:

ADX

The average directional index (ADX) is a trend indicator used to measure the strength and momentum of an existing trend. This indicator’s main focus is not on the direction of the trend, but with the momentum. When the ADX is above 40, the trend is considered to have a lot of directional strength – either up or down, depending on the current direction of the trend. Extreme readings to the upside are considered to be quite rare compared to low readings. When the ADX indicator is below 20, the trend is considered to be weak or non-trending.

Fibonacci Retracements

Fibonacci retracement lines are based on the Fibonacci Sequence and are considered a “predictive” technical indicator providing feedback on possible future exchange rate levels. There are some traders who swear by the accuracy by which Fibonacci Retracements can predict future rates, while others argue that Fibonacci numbers are more art, than science.

Given their popularity and widespread usage by technical analysts, you should at least know how to interpret Fibonacci numbers. One word of caution however, like any indicator it is wise to seek feedback from additional sources to bolster your initial analysis before basing a large trade solely on the “Fibs”.

By placing the Fibonacci lines over the price chart and extending the lines past the current spot rate, you can locate each of the potential retracement points and, if you wish, adjust your trading strategy based on this feedback. Retracement refers to the tendency for a currency pair to “correct” after a particularly large rate swing moves the currency pair into an overbought or oversold position.

One strategy used by some traders is to use Fibonacci Retracement levels as guidelines for placing stop loss limits.

Support and Resistance Lines

Support and resistance analysis is used by technical traders to make trading decisions and identify when a trend is accelerating or reversing. Being aware of these important levels should affect the way you trade and help you make trading decisions: enter a trade, place stop loss or a take your profits.

Support line : Is the level where the price tends to find support and tend to reverse after touching it

Resistance: Is the level where the prices hits resistance and tend to fall after hitting this level

How to trade Support or Resistance lines signals :

- BUY signal: when price touches the support line

- SELL signal: when price touches the resistance line

- If price breaks below support, then that support level becomes the new resistance level.

- If price breaks above support, then that resistance level becomes the new support level.

Pivot Points

Pivot Points are used to project potential support and resistance levels using the high, low and close prices of the previous period. The main time periods used are daily, weekly, and monthly pivots.

The calculation of Daily Pivot Points varies in accordance with the closing time of the market – but remember that Forex is open 24 hours so ‘closing time’ depends on your Broker’s platform. Forex traders mostly use either 16:00 EST for New York bank settlements close or London midnight for the closing price.

Pivot points are used to determine directional movement, the support and resistance and consists in a set of horizontal support and resistance lines. he main line is called the main pivot point or daily pivot, the point at which the market is said to “pivot” around. After the main pivot point has been calculated, this is then used to calculate the other corresponding pivots points.

The pivot points above the daily pivot are labelled as resistance pivots, notably R1, R2, etc. If they are below, they are support pivots, labelled S1, S2, etc.

They are mostly calculated using a 5-point-system, comprised of:

- The median pivot point (PP)

- Two resistance levels (R1) and (R2)

- Two support levels (S1) and (S2)

How to trade Pivot Points signals :

Support and resistance levels based on Pivot Points can be used just like traditional support and resistance levels. The key is to watch price action closely when these levels come into play.

Candlestick formations

There are many candlestick patterns but only a few are actually worth knowing. They should be combined with other forms of technical analysis to really be useful.

A candlestick depicts the battle between Bulls (buyers) and Bears (sellers) over a given period of time. The candlestick in itself can be bullish or bearish but the analysis must take into consideration the formation of candlesticks – if it is a continuation pattern or a reversal.

Leave a Reply