Trading Strategy

Plan Your Trading Strategy

Before you go ahead and start trading any markets with real money, you must come up with a trading strategy plan.

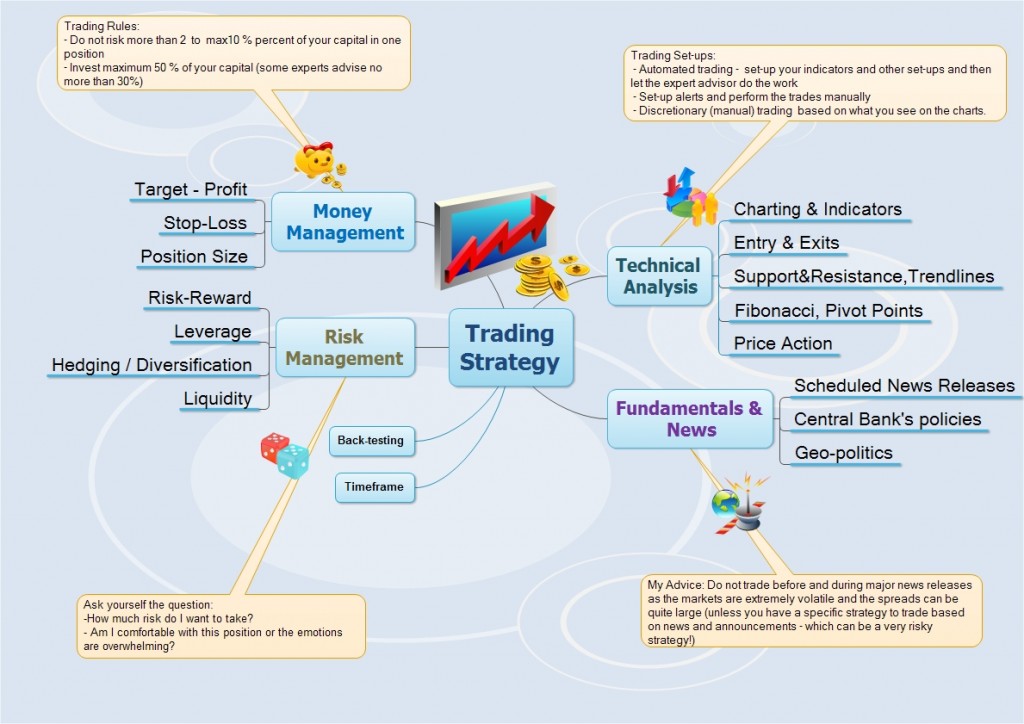

The most important topics that are the building blocks for your trading strategy plan are: Technical Analysis, Fundamental Analysis, Risk & Money Management principles.

Take your time, study them in details and after you are familiar with each topic then you should try to come up with your own trading strategy. I also suggest to have a think about your personality – do your self-analysis and get to know what are your strong points. Choose the strategy that is matching with your style.

What time-frame are you planning to trade

On of the very first decisions that you have to make is about the time-frame that are you planning to trade. Timeframe chosen will impact the charts and indicators that you may use for performing your Technical Analysis and also will impact on your Risks and Money managements rules.

Scalping , day trading, short term trading or long term trading?

The lower the timeframe, the quicker and more flexible you need to be in adjusting to changes – and the more likely you will get fake-outs, so be nimble and have your strategy fine tuned accordingly. Higher timeframes will give you more time to adjust to changing conditions and your trading efficiency could be higher.

Also be aware that the markets behave differently at certain times of day – for example at the time when ASX or NY opens. Knowing this can be very valuable for your choosing you timeframe for trading and when to trade.

What financial instrument to day trade

Usually for L-plate traders, it is good to stick with one market – could be ASX shares and/or CFDs, Future Contract for a major Index ( ASX SPI or DAX or S&P Mini)

As you become a more experienced trader you might decide to trade multiple instruments instead. Don’t be shy in exploring the full spectrum of financial instruments that are on offer with your broker or other brokers to see what is going to best suit your system.

Backtesting

Developing a Forex trading strategy will be a trial and error exercise. You’ll need to test your system and make sure you are happy with the results. The safest way to test your strategy is to perform back-testing.

Word of advice: there is no single strategy that guarantees perfect trades but there are strategies that work better in different markets. If you can devise a series of strategies for different market types, and then recognise the type of market you are dealing in, you will be a long way towards becoming a successful trader.

Leave a Reply