Trading Styles – what is your style?

Trading Styles – Ten Types of Trading Styles

Trading Styles – Ten Types of Trading Styles

If you’re not sure about the answer to the question “What is your trading style?” then keep reading our description or various trading styles – this article is attempting to classify the vast diversity of trading styles into a finite number of categories to make it easier for the beginners to comprehend how much variety exists in the market in terms of trading opportunities.

While it is very important to choose the trading styles which suits your personality and preferences you should know that most successful traders adopt a combined approach. Trading psychology is an important component of the overall trading success so if you want to become successful you will need to prioritize a style according to how your mind works.

Also worth noting that many successful traders are more opportunity-centric than system or style centric. A multi-faceted approach usually gives better results. However, it is important to have a primary trading style in which other facets can be incorporated.

So let’s look at the 10 generic types of trading styles so we hope it will make it easy for you to choose:

1. Intraday Trading

1. Intraday Trading

Intraday trading or day trading style is most commonly practiced by retail traders in various markets as positions are squared off before the closing hours of the market. Intraday trading philosophy is that overnight exposure is risky due to international developments.

Intraday trading is one of the most aggressive types of trading styles. Intraday trading format thrives on days with high volatility as the numbers of opportunities do go up during such times. Intraday traders, also known as day traders, tend to take profits or losses relatively quickly and trade multiple times every day. It suits people who are least bothered about fundamentals or the things that are considered important to be a successful investor in the long-run. For day traders it is very important to be disciplined in terms of money management, timing their entries & exits and their position size.

Day traders can either be trading the momentum or take trades counter trend. Also the intraday trading involves taking on additional leverage to generate higher returns. They are always looking to make higher returns in their investment than other trading formats. A successful intraday trader understands the importance of consistency and the power of compounding returns on a short-term basis. If consistency is maintained, then returns can be compounded on a monthly or quarterly basis.

Intraday trading is only suitable for those who can fully dedicate their time to tracking the movements of stock markets and make quick decisions.

2. Swing Trading

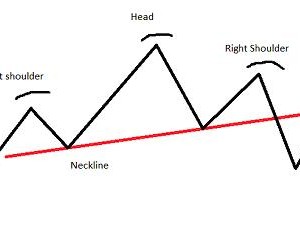

Swing traders attempt to predict the short-term fluctuation in prices over few days. Swing trading and day trading are very similar trading styles – the principal difference between intraday trading style and swing trading style is the timeframe – positions can last anywhere from 1 day to a few weeks.

The leverage used by Swing traders is generally lesser than intraday trading. In a way, it enables traders more firepower to withstand overnight price movements and hold positions for longer hence trying to book higher profits per trade. Most technical traders and chartists fall in this category. If you like to analyze short-term price movements using technical analysis, then this is your ball game. True swing trading also involves a great deal of money flow analysis.

Swing trading is rewarding and the price movements are more predictable. However risk management is also very important and it needs to be more sophisticated as you have to get used to ignoring minor intraday fluctuations /noise without being too stressed or getting overly concerned. A lot of swing traders may also do intraday trading but it is up to the individual risk tolerance where to draw the line and focus on specializing in one or the other style of trading.

I must point out that in general you need more capital to swing trade in comparison to intraday trading because overnight trades require more margins. Ideally, you should also keep some buffer capital and not be 100% invested at all times to account for the volatility and avoid margin calls of any sort.

3. Position Trading

3. Position Trading

As the name ‘position trading’ suggest this style of trading means longer period of time where trader takes a position in the market in anticipation of a big price movement in the near future – for example it can be days, weeks or even months. Therefore timing the market is not the top priority for this category of traders as they are willing to weather the storm and wait out a few months to see a large gain.

Position trading is a type of trading style which ignores the minor short-term fluctuations that swing traders are fully focused on. Position trading involves lesser leverage than swing trading. Position traders are focusing usually on a hybrid between technical analysis and fundamentals. To be able to hold positions for a longer time period, they feel like they have to be sure of what’s happening within the company. They’re usually looking for the underlying stock to gain more than 20% in the near future. Position traders have the aptitude and inclination to lean more towards investing in the long run.

Position trading style is in general used for trading future contracts or investing in equity without leverage.

4. Options trading

Is your thought process very analytical and mathematical? If you like outcomes to be clearly defined and measurable then trading options may be your thing. When trading options most traders are using different strategies. Some of those options strategies entail buying and selling in the same time.

You can find easily information regarding the most common options strategies such as straddles, butterflies, etc. You can also take your time to become proficient and start making your own strategies and implement.

The advantage of trading options strategies is scalability and the fact that it requires less time and attention than other styles of trading primarily because the risk is defined.

5. Technical Analysis Trading

5. Technical Analysis Trading

Almost all kinds of trading activity revolves around technical analysis because of its diversity and different approaches to analyse demand and supply in the markets. As long as you know how to apply it, you can be a day trader, swing trader or position trader. The underlying knowledge required is similar. However, it may not be fully relevant in the following trading styles and the concept of analysing opportunities is completely different.

Almost all traders including institutional ones, banks etc. use technical analysis in their trading.

6. Money Flows Trading

You may have heard the expression “follow the money”? Trading with the ‘money flow’ is based more on sentiment in the market and using various sources of information and trying to gauge the flow of money. Useful sources of information are the publications such as investment sentiment surveys, Commitment of Traders (COT) market reports, Open Interest analysis, promoter deals, stake sales, gross delivery data, Index rebalancing etc. More often, than not, this data is vital to identify the near term trends in the stock market. Many professional traders give such information first priority and then back it up by technical analysis of stocks and indices.

If you are the kind who likes analysing the bigger picture for money flows then this type of trading can be rewarding. Such information is especially useful if you are a swing trader. This information is also useful to analyse the short term sentiment of participants. For instance, advance decline ratios fluctuating before meetings of the reserve banks is enough to suggest that this method is very useful in gauging the near term future.

7. Event Based Trading

Trading based on events or news that have occurred or ones that are about to occur is a type of trading style in itself. Events/news can range from good earnings results for companies reporting , change in government policies, geopolitical events, announcements of mergers and acquisitions, restructures in companies including change in management, change in price of raw materials, one time dividends, natural calamities, new innovations etc.

The main challenge in even based trading is to identify trading opportunities based on events or news. It does require a fair understanding on fundamentals and technical analysis. If you wonder how technical analysis is relevant I must remind you that the markets anticipate events before they occur.

In many cases, when an event is already priced in it is best to change your stance – buy the rumour and sell the news! Technical analysis helps identify this quite easily. If you like doing research and wait for such opportunities then you should make it worth it.

8. Quantitative trading

Quantitative trading definitely requires knowledge of programming, a good trading capital and computing speed so it is not for everyone. It is often misunderstood as high frequency trading and automated algorithmic trading but in reality it isn’t. Quantitative analysis is analysing stocks based on statistical performance. For instance, if International Energy Agency (IEA) forecasts that the price of Brent Crude Oil will be headed downwards due to the supply glut expected in Saudi Arabia. The quant program analyses historical patterns when such news has occurred and the impact it has had on oil prices and other correlated asset classes and presents it with a risk/reward ratio based probability so that you can take a good trading decisions.

Quantitative trading does not necessarily need to be HFT or even algorithmic order execution. It just means that the method of analysing stocks is based on computer models to increase efficiency and most Importantly it requires the right knowledge of markets to be able to analyse data correctly. No amount of programming will give you the desired results if you lose focus of the markets. It is better to learn about markets thoroughly before you attempt this.

9. Arbitrage Trading

Arbitrage trading was used in the past by some retail traders but it is not lucrative anymore and strategies have gotten more advanced involving some element of risk. This style of trading is nowadays reserved only for the prop trading firms and institutional traders as it requires great network speed and does not require superior analysis skills. There are many different kinds of risk arbitrage models which can only be exercised by institutions or large traders due to the sheer complexity of information acquisition, and risk management skills. Only enter the field if you’re obsessed with no risk profits. Otherwise, you might get bored soon.

10. High-Frequency Trading (HTF)

High-frequency trading style is all about SPEED. The strategies have all got to do with manipulating bids and offers (Bid/ask) at a fast pace. This breed is looking to make the smallest profits per trade and do hundreds or thousands of transactions in a day.

Currently, institutions and hedge funds compete in this space in the microseconds. As we speak, it has got less to do with brains and more to do with speed so it is not recommended at all.

If this is what you want to do, then try starting your own fund or joining one as a programmer. These are fully automated and the speed of the order execution is paramount.

Conclusion

Most successful traders adopt a combined approach when it comes to their trading style. They are more opportunity-centric than system centric. A multi-faceted approach usually gives better results.

However, it is important for every trader to have a ‘base style of trading’ in which other facets can be incorporated.